inherited annuity tax calculator

A non-qualified annuity is an investment purchased outside of a work-related retirement plan using after-tax dollars. How taxes are paid on an.

Taxation Of Annuities Explained Annuity 123

HM Revenue Customs.

. Use this calculator to help you work out an estimated market value of guaranteed annuity payments when valuing assets of the deceaseds estate. Dear Allen If you were born before Jan. Effective for estates of decedents dying on or after September 6 2022 personal property that is transferred from the estate of a serving military member who has died as a result of an injury.

Tax Rules for Inheriting an Annuity. Get The FREE 2022 Gold IRA Kit Americans Are Using to Protect. This calculator can estimate the annuity payout amount for a fixed payout length or estimate the length that an annuity can last if supplied a fixed payout amount.

This means the money was already taxed before it was put into the annuity. Nonqualified Inherited Annuities Only the interest earned will be subject to taxes. Diversify and protect your 401k IRA and retirement savings accounts.

Here are some of the most common methods to avoid paying taxes on an inherited annuity. 2 1936 and the lump-sum distribution is from a qualified retirement annuity you may be able to elect up to five optional methods of calculating your tax. Calculate how much interest is due on a payment of.

If you expect to inherit an annuity its important to consider beforehand how that might affect. If the contract was purchased with after-tax funds meaning money that has been reported to the IRS as income and taxed accordingly then the annuity is non-qualified. The timing of the tax event depends on the payout structure and your status as a beneficiary.

For estates above the threshold only the amounts that exceed the threshold for that year are taxable. Get an approximate value of an estate and decide if any Inheritance Tax is likely to be due. If you have inherited a retirement account generally you must withdraw required minimum distributions RMDs from.

Inherited Non Qualified Annuity Stretch Calculator. Qualified Inherited Annuities All death benefits will be subject to taxes. These annuities have already been subject to income tax however any.

Inheritors of non-qualified annuities purchased with pre-tax. Calculate the required minimum distribution from an inherited IRA. Due to marital deduction the.

Doing so allows you to keep the same options as the original owner including the. With non-qualified annuities funds come from post-tax dollars. The calculator can help determine this threshold.

The tax rate on an inherited annuity is determined by the tax rate of the person who inherits it. Inheritance Tax interest calculator. But there are things you can do to defer payment on what you inherit.

This means that 50 of the monthly payout from the annuity would be taxed as earnings and 50 would be untaxed. If you have inherited your spouses annuity you can choose to transfer the annuity contract into your name. Inherited Non-Qualified Annuity Taxes.

An inherited IRA is an account opened to distribute the assets of a deceased owner of an individual retirement account IRA or employer-sponsored plan to the beneficiary or. People inheriting an annuity owe income tax on the difference between the principal paid into the annuity and the value of the annuity at the annuitants death. Because your wife chose to cash in the annuity a portion of what she received will be income from the invested funds.

The earnings are taxable over the life of the payments. Like any other type of income inherited annuities are taxable.

How To Avoid Paying Taxes On An Inherited Annuity Smartasset

Do I Pay Taxes On All Of An Inherited Annuity Or Just The Gain

Retire Early Ira Withdrawal Calculator And Roth Analyzer

Annuity Beneficiaries Inheriting An Annuity After Death

Opinion What Are The Tax Rules Around Inheriting An Annuity Marketwatch

Annuity Interest Rate Calculator Find Your Apr New York Life

Rmds And Iras Identifying Options For Inherited Retirement Accounts The Krause Agency

Do I Have To Pay Taxes When I Inherit Money

Wealth Transfer Retireone For Rias

Understanding How Taxation Of Annuities Can Impact You Farm Bureau Financial Services

How To Calculate Taxes On An Annuity

/cdn.vox-cdn.com/uploads/chorus_asset/file/22363424/210308_fciccolella_voxmedia_inheritance_secondaryillustration.jpg)

How Inheritance Became A Gift A Necessity And A Curse Vox

Non Qualified Annuity Tax Rules Immediateannuities Com

4 Questions To Ask Before Buying An Annuity Charles Schwab

Inherited Annuity Tax Guide For Beneficiaries

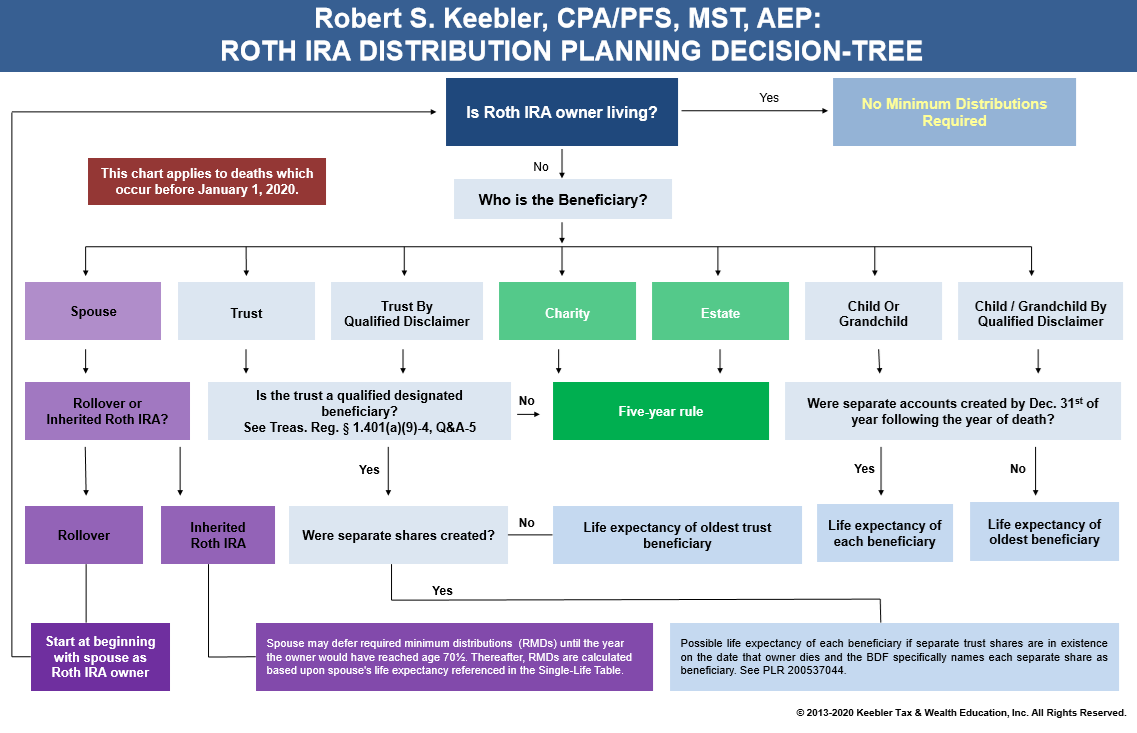

2022 Roth Ira Distribution Chart Ultimate Estate Planner

How To Avoid Paying Taxes On An Inherited Annuity Smartasset